In recent years, e-cigarettes have become increasingly popular among consumers looking for alternatives to traditional smoking. As the use of e-cigarettes continues to rise, the government is considering taxing these electronic devices. The implications of such a decision are significant, and it’s crucial to understand both the potential benefits and challenges of implementing a tax on e-cigarettes.

Understanding E-Cigarettes and Their Appeal

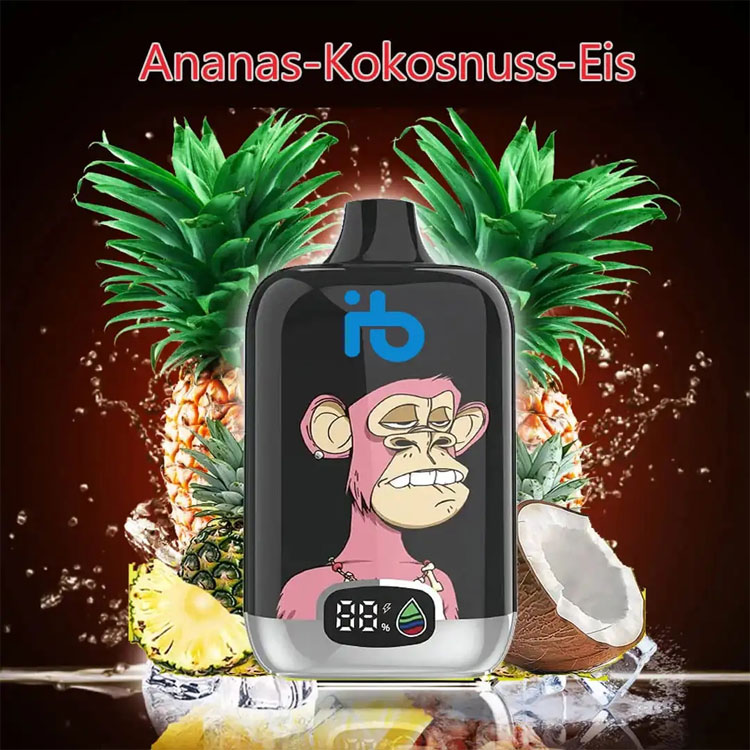

E-cigarettes, or electronic cigarettes, are battery-operated devices that deliver nicotine through vapor rather than smoke. Users, often referred to as “vapers,” inhale vaporized liquids, known as e-liquids or vape juice. These liquids typically contain nicotine, flavorings, and other chemicals. One of the primary reasons for their popularity is the perception that they are a safer alternative to traditional tobacco smoking. For many, the appeal lies in the variety of flavors and the absence of the pungent odor associated with conventional cigarettes.

Considerations for Taxation

The debate around taxing e-cigarettes involves numerous factors. Firstly, such a tax could serve as a new revenue stream for the government, potentially offsetting healthcare costs associated with smoking-related illnesses. Secondly, it may act as a deterrent, particularly for younger individuals who might be drawn to vaping due to its perceived safety and appealing flavors. However, there are also concerns that taxing e-cigarettes may discourage smokers from switching to a less harmful alternative or could even drive consumers to seek products in an unregulated, black market.

Potential Benefits of Taxing E-Cigarettes

- Generating Additional Revenue: A tax on e-cigarettes could significantly boost government funds, which could then be allocated towards public health initiatives, educational programs, and other essential services.

- Encouraging Healthier Choices: By imposing additional costs on e-cigarettes, the government may promote healthier lifestyle choices and potentially reduce the number of new vapers, particularly among young people.

- Public Health Impact: With fewer people taking up vaping, there could be long-term benefits in reducing nicotine addiction and the health complications associated with it.

Challenges and Concerns

Impact on Current Smokers: For many smokers, e-cigarettes offer a way to reduce or quit smoking tobacco. By taxing these products, there’s a risk of discouraging this positive change. Market Effects: Implementing a tax on e-cigarettes could lead to an increase in black market activities, as consumers search for more affordable alternatives. Innovation and Growth: The burgeoning e-cigarette industry thrives on innovation and development. Over-regulating or overly taxing the industry might stifle growth and limit consumer options.

Conclusion

As the government weighs the potential taxation of e-cigarettes, it must consider the myriad of impacts such a move could have. While there are undeniable benefits, including revenue generation and potential health improvements, the drawbacks cannot be overlooked. A balanced approach, perhaps involving regulation that addresses both safety concerns and taxation, could be the most beneficial path forward.

Frequently Asked Questions (FAQs)

Q1: Why are e-cigarettes being considered for taxation now?

A: As e-cigarette use grows, governments see an opportunity to generate revenue and potentially curb usage, creating a public health benefit.

Q2: Could taxing e-cigarettes lead to increased smoking rates?

A: There is a concern that higher prices might deter smokers from switching to e-cigarettes and could instead keep them using traditional cigarettes.

Q3: Are there countries that already tax e-cigarettes?

A: Yes, several countries have implemented taxes on e-cigarettes to various extents, often aligning them with traditional tobacco tax policies.