In recent years, vaping has become a global phenomenon, and with the onset of 2025, the intricacies surrounding the importation of e-cigarettes into Thailand have garnered significant attention. As concerns over health and safety become more prominent, understanding Thailand’s evolving regulations and guidelines regarding e-cigarette imports is crucial for businesses and consumers alike. This article explores these rules, offering insights into compliance and the challenges faced in the realm of international commerce.

Understanding the 2025 Regulatory Landscape

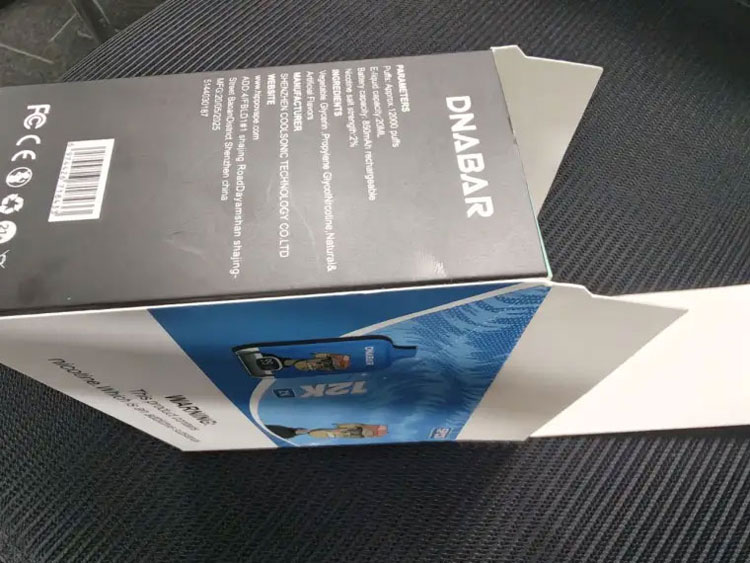

Thailand has historically maintained strict regulations concerning tobacco and nicotine products. As we approach 2025, these regulations are expected to tighten further, impacting how e-cigarettes and related products can be imported into the country. One key aspect is the age restrictions imposed by Thai law, which prohibits the sale of these products to individuals under the age of 20. Additionally, product labeling and packaging must adhere to stringent standards, ensuring that health warnings and ingredient information are prominently displayed.

Impact on E-Cigarette Businesses

For companies aiming to navigate the e-cigarette market within Thailand, it’s imperative to stay informed about these import rules. Compliance with Thailand e-cigarette import rules in 2025 involves understanding detailed regulatory requirements, including customs documentation, and the need for potential product reformulation to meet local standards. Companies that fail to adhere to these guidelines risk significant fines and the possibility of confiscation of their products by Thai customs.

Challenges in Compliance

- Understanding Thai language requirements for product labeling can pose challenges for foreign companies.

- Adapting to packaging regulations which may differ significantly from international standards.

- Ensuring product compositions are verified and align with health safety standards as mandated by Thai authorities.

The rise in health-related concerns about vaping has led to increased scrutiny and potential updates to the regulations governing e-cigarettes. This means businesses must regularly check for amendments to ensure their products remain compliant with current laws.

Legal Risks and Penalties

Ignoring these regulations could lead to severe legal repercussions. The Thai government imposes strict penalties for non-compliance, ranging from heavy fines to imprisonment for severe violations. Furthermore, such infractions could harm the reputation of businesses involved, leading to losses beyond mere financial penalties.

Adapting to Cultural Sensitivities

While navigating these regulatory waters, it’s crucial for businesses to adapt to cultural sensitivities. Thai consumers often hold strong opinions about health-related products, which e-cigarette companies must factor into their business strategies. This involves targeted communication strategies that underline product safety while respecting local cultural norms.

Strategic Approaches for Successful Importation

Developing partnerships with local distributors can offer foreign companies critical leverage, aiding in the successful navigation of regulatory barriers. Engaging with regulatory bodies proactively can also help in understanding upcoming changes in legislation, ensuring compliance before new laws take effect.

Moreover, leveraging technology to streamline compliance processes, such as automated systems for tracking regulatory updates, can be instrumental in maintaining adherence to Thailand e-cigarette import rules in 2025. This strategic foresight allows businesses to stay ahead in an evolving market landscape.

FAQ on Thailand E-Cigarette Import Rules 2025

What specific documentation is required for importing e-cigarettes into Thailand?

Importers need to provide detailed customs documentation, including product specifications, proof of compliance with safety standards, and any applicable certifications. Engaging with a customs broker familiar with Thai electronics import regulations can be advantageous.

Are there tax implications for importing e-cigarettes to Thailand?

Yes, there are specific import taxes imposed on e-cigarettes and related products. The rate can vary depending on the product’s value and composition, so it’s advisable to consult with tax professionals for accurate calculations.